Blog

May 2023 Market Commentary

May 2023 Market Commentary

“There is an inevitable divergence between the world as it is and the world as men perceive it.”

-J. William Fulbright

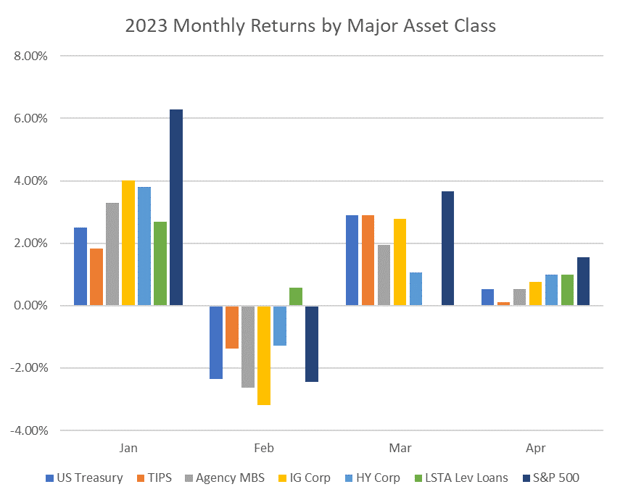

April provided markets a respite from the turbulence experienced in the first quarter of the year. It was a moment of calm bridging early-year rate hike fears and the ensuing banking crisis with a new set of concerns related to the debt ceiling and the potential onset of recession as early as the second or third quarter. During the month, virtually all major financial asset classes enjoyed modest positive returns (see Exhibit 1). Oil and gold prices were also flat to slightly higher.

Exhibit 1. Monthly Major Financial Asset Class Returns, Jan. 2023 – Apr. 2023

Source: Bloomberg and AAFMAA Wealth Management & Trust

Brief Thoughts About the Economy, the Market, and the Debt Ceiling Crisis

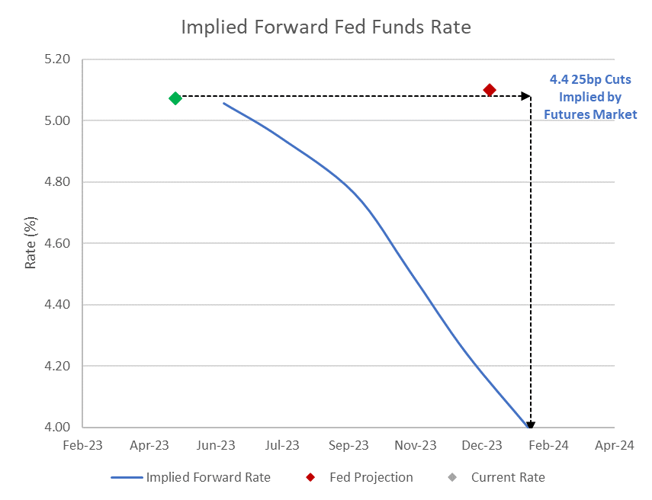

The economic environment continues to be driven by two very different views of the forward path of interest rates. Despite consistent Federal Open Market Committee (FOMC) guidance that additional rate hikes are still possible this year – and that rate cuts are unlikely – pricing in the Fed Funds futures market implies that there will be more than four 25bp cuts by the end of January 2024. That change would equate to a new Funds rate of about 4.0%. In contrast, the FOMC projects a much higher rate of 5.10% at the end of 2023 (see Exhibit 2). If futures pricing does indeed reflect the world as market participants perceive it, then, in the spirit of Senator Fulbright’s quote above, we believe that reality and market expectations are likely to diverge.

Exhibit 2. Futures Market Implied Fed Funds Rate

Source: Bloomberg and AAFMAA Wealth Management & Trust

The unfortunate implication is that short rates would stay elevated in a scenario where the Fed felt that it needed to continue tightening credit to fight inflation. The fear has always been that, in sustaining high rates, the Fed would push the economy into recession. The extreme divergence that futures pricing is signaling, suggests that the bond market believes the Fed has already set a near-term recession into motion and that inflation will flame out rapidly. Therefore, the divergent views are more about whether the economy experiences a 1970s-style low-growth high-inflation recession (the Fed’s concern) or a more typical low-growth low-inflation recession. Either way, we’re not left feeling nearly as bullish as we’d prefer.

As the middle of May approaches, we’re strongly considering raising cash levels by reducing the weighting of equity market holdings. One reason would be to prepare for a difficult economic environment. The other reason would be to maintain extra liquidity while lowering exposure to an adverse equity market reaction if negotiations to raise the debt ceiling limit are unsuccessful and the US government defaults on its payment obligations. In the two prior debt ceiling crises, markets behaved quite differently. In the first crisis during the summer of 2011, the S&P 500 traded lower by more than 18%, taking about six months to recover its losses. In the second crisis during 2013, the markets not only brushed off contentious negotiations, but also realized an unusually high annual return of about 32%.

We’re confident that all negotiating parties understand the catastrophic implications of a failure to prevent a US government default, and we believe that the most likely case is that a deal is reached in time. However, we also appreciate the degree of political divisiveness that currently exists – and the non-zero probability that the government does indeed default. While there’s a mitigating argument that markets have learned to anticipate debt ceiling political brinksmanship and intense media coverage, the fact that there’s even a slight possibility that a default could occur means that the equity markets will become more fragile and liquidity will become scarcer as we approach June 1st, the date on which Treasury Secretary Yellen has projected that the Government could run out of money. Unlike in recent years, the cost of increasing liquidity is not that expensive. Money market funds yielding more than 4.5% provide an attractive short-term alternative to event-risk.

Memorial Day weekend could be quite exciting this year! Thanks very much.

Yours in trust,

Paul Jablansky

Chief Investment Officer

Increase Your Financial Wellness with AWM&T

At AAFMAA Wealth Management & Trust LLC, we are committed to serving the unique financial needs of the military community. Whether you require a complimentary portfolio review, a comprehensive financial plan, assistance with your investment strategy, or trust services, our military wealth management professionals are ready to serve you. Contact us today to set up an appointment with a Relationship Manager who can assess your financial health and customize your personalized action plan.

About Us

Founded in 2012, AAFMAA Wealth Management & Trust LLC (AWM&T) was created to meet the distinct financial needs of military families. We proudly deliver experienced, trustworthy financial planning, investment management, and trust administration services – all designed to promote lasting security and independence.

We are proud to share the mission, vision, and values of Armed Forces Mutual, our parent company. We consistently build on the Association’s rich history and tradition to provide our Members with a source of compassion, trust, and protection. At AWM&T, we are committed to serving as your trusted fiduciary, always putting your best interests first. Through Armed Forces Mutual's legacy and our financial guidance, we provide personalized wealth management solutions to military families across generations.

© 2023 AAFMAA Wealth Management & Trust LLC. Information provided by AAFMAA Wealth Management & Trust LLC is not intended to be tax or legal advice. Nothing contained in this communication should be interpreted as such. We encourage you to seek guidance from your tax or legal advisor. Past performance does not guarantee future results. Investments are not FDIC or SIPC insured, are not deposits, nor are they insured by, issued by, or guaranteed by obligations of any government agency or any bank, and they involve risk including possible loss of principal.

Get In Touch!

Schedule a consultation with one of our expert financial planners today, and let's hit the fast-track to success!

Schedule A Consultation