Blog

June 2023 Market Commentary

June 2023 and Year-to-Date Market Performance

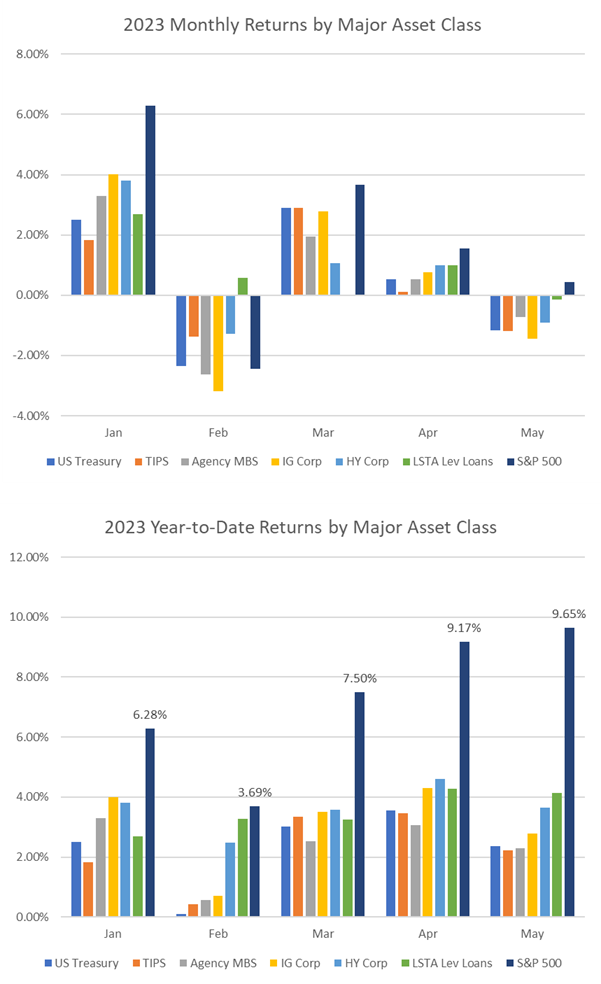

With the exception of the equity market, which was up marginally, most major asset classes realized negative performance in May. Nevertheless, year-to-date returns have been strong. The S&P 500, for example, was up 9.65% through the end of May (see Exhibit 1).

Exhibit 1. 2023 Monthly and Year-to-Date Returns

Source: Federal Reserve Board Summary of Economic Projections, June 14, 2023

Economic and Market Commentary

“The right word may be effective, but no word was ever as effective as a rightly timed pause.”

-Mark Twain

In the spirit of Mark Twain, Federal Reserve Chairman Jerome Powell undoubtedly hopes that when he writes his memoir, he can look back at the June 2023 Federal Open Market Committee (FOMC) meeting and conclude “the right rate hike may be effective, but no hike was ever as effective as a rightly timed pause.”

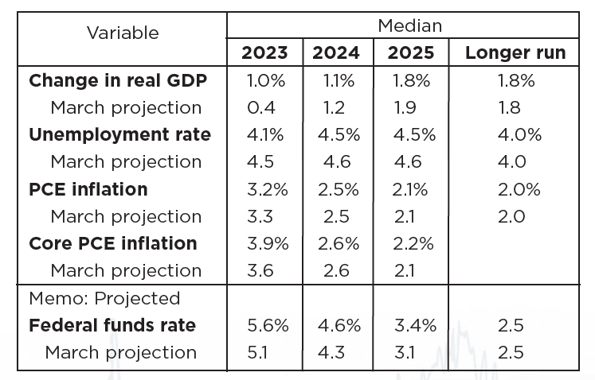

The Fed did indeed take a well-telegraphed pause from hiking in its latest meeting. They also released updated FOMC economic projections reflecting stronger than previously expected short-term economic growth (see Exhibit 2). In the projections, they:

- Upgraded estimated year-end GDP growth from 0.4% to 1.0%

- Reduced the estimated year-end unemployment rate from 4.5% to 4.1%

- Reduced the estimated year-end inflation rate slightly from 3.3% to 3.2%

- Increased year-end estimated Core PCE inflation from 3.6% to 3.9%, and

- Increased the year-end estimated Fed funds rate from 5.1% to 5.6%

The Fed also increased their year-end 2024 and 2025 Fed funds rate projections. The pause will give them several weeks to observe whether the downward momentum in economic activity is enough to avoid further hikes, though we believe that will be a challenge.

Exhibit 2. Selected FOMC Economic Projections as of June 14, 2023

Source: Federal Reserve Board Summary of Economic Projections, June 14, 2023

Over the past several weeks, both the Fed and investors have made abrupt shifts in their views of future short-term interest rates. In our May commentary, we showed that, while the median Fed forecast was for an end-of-year Fed Funds rate of 5.1%, futures market pricing was implying a much lower 4.0% rate. In other words, futures market participants were implausibly anticipating that the Fed would reduce rates by more than 100 basis points (bp) by year-end 2023 when the Fed was openly saying that they expected rates to go marginally higher.

Only one month later, futures market pricing implies that Fed Funds will both rise and fall by about 25bp prior to January, suggesting that the Fed will also implausibly hike and reduce rates by 25bp in the second half of the year. In contrast, the updated median Fed forecast projects that Fed Funds will move 50bp higher over the same period. Both the Fed and investors have become significantly less optimistic.

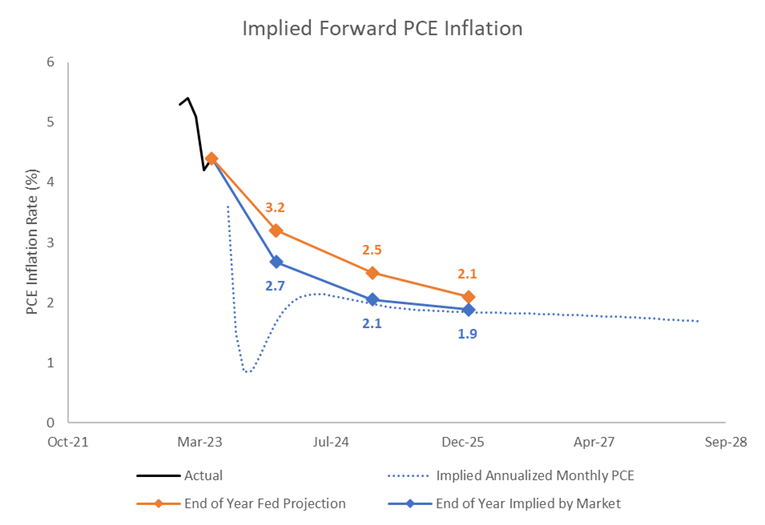

Exhibit 3. Views of Future Inflation

Source: Bloomberg and AAFMAA Wealth Management & Trust

The disconnect between market pricing and Fed projections also applies to inflation through at least 2025. Even though it’s already late June, bond market pricing and the Fed are projecting annual inflation rates for full-year 2023 of 2.7% and 3.2%, respectively (see Exhibit 3). That half percentage point difference is significant considering that we already know actual inflation through April was approximately 1.4%. In the chart, the black line reflects actual inflation since December 2022. The solid blue line shows the end-of-year inflation rates for 2023 – 2025 implied by market pricing. The dotted blue line shows the annualized month-by-month path of inflation implied by market pricing, and the orange line shows the Fed projections.

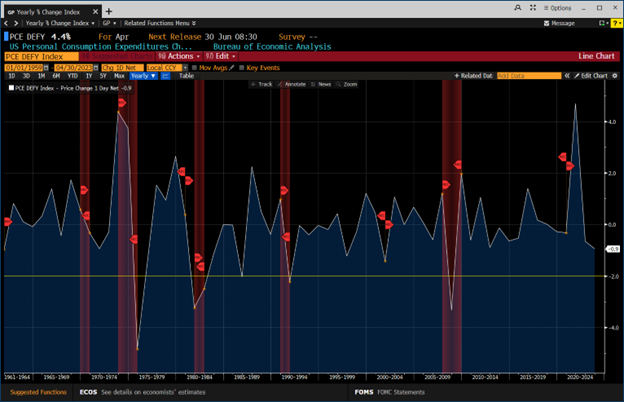

More importantly, regardless of whether the bond market or the Fed is right – if either – full-year inflation rates of 2.7% and 3.2% would equate to annual changes in inflation of -2.6% and -2.1%, respectively. Unfortunately, as Exhibit 4 demonstrates, there hasn’t been a calendar year since at least 1960 with a decline in inflation of that magnitude that hasn’t been associated with a recession. The white curve in Exhibit 4, which is a screenshot from Bloomberg, shows annual changes in inflation; the red-shaded areas show periods of recession. The constant yellow horizontal line at -2.0% denotes the largest one-year negative change in inflation that was not associated with recession.

Exhibit 4. Annual Changes in PCE Inflation and Recessions

Source: Bloomberg and AAFMAA Wealth Management & Trust

We wish we could be a little more enthusiastic about the economy. We certainly could be surprised to the positive, but our investment outlook remains consistent. Over the past two months, we’ve taken a more defensive posture by adding allocations to Treasury Inflation-Protected Securities (TIPS) and the iShares Gold Trust ETF, and by reducing allocations to the equity markets. We anticipate remaining defensive through year-end but will take advantage of opportunities as they arise.

Yours in trust,

Paul Jablansky

Chief Investment Officer

Increase Your Financial Wellness with AWM&T

At AAFMAA Wealth Management & Trust LLC, we are committed to serving the unique financial needs of the military community. Whether you require a complimentary portfolio review, a comprehensive financial plan, assistance with your investment strategy, or trust services, our military wealth management professionals are ready to serve you. Contact us today to set up an appointment with a Relationship Manager who can assess your financial health and customize your personalized action plan.

About Us

Founded in 2012, AAFMAA Wealth Management & Trust LLC (AWM&T) was created to meet the distinct financial needs of military families. We proudly deliver experienced, trustworthy financial planning, investment management, and trust administration services – all designed to promote lasting security and independence.

We are proud to share the mission, vision, and values of Armed Forces Mutual, our parent company. We consistently build on the Association’s rich history and tradition to provide our Members with a source of compassion, trust, and protection. At AWM&T, we are committed to serving as your trusted fiduciary, always putting your best interests first. Through Armed Forces Mutual's legacy and our financial guidance, we provide personalized wealth management solutions to military families across generations.

© 2023 AAFMAA Wealth Management & Trust LLC. Information provided by AAFMAA Wealth Management & Trust LLC is not intended to be tax or legal advice. Nothing contained in this communication should be interpreted as such. We encourage you to seek guidance from your tax or legal advisor. Past performance does not guarantee future results. Investments are not FDIC or SIPC insured, are not deposits, nor are they insured by, issued by, or guaranteed by obligations of any government agency or any bank, and they involve risk including possible loss of principal.

Get In Touch!

Schedule a consultation with one of our expert financial planners today, and let's hit the fast-track to success!

Schedule A Consultation