Blog

December 2023 Market Commentary

December 2023 Commentary

November 2023 and Year-to-Date Market Performance

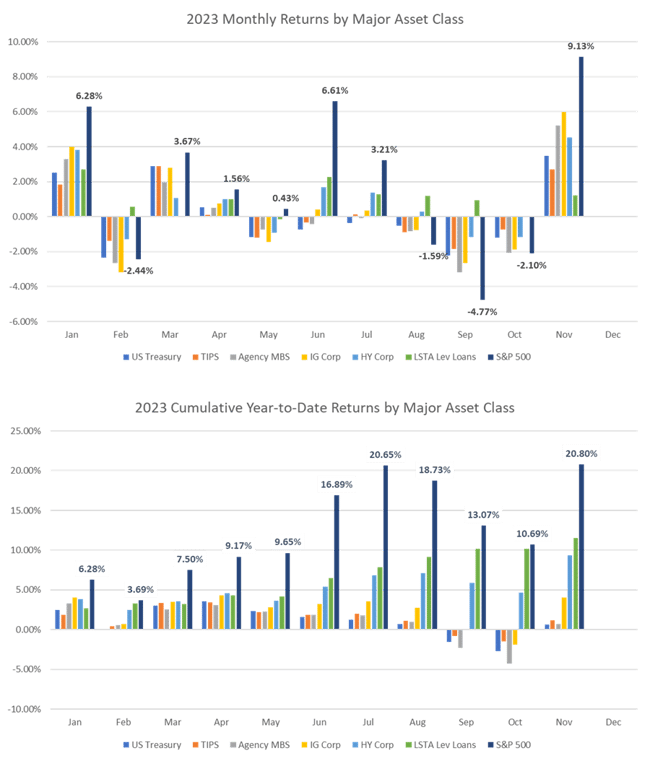

November returns were remarkably strong across asset classes. Positive economic data drove investors to lower their assessment of the odds of recession and allocate capital into fixed-rate bonds and equities. Following a rough three months spanning August through October, the 10-year U.S. Treasury yield declined by 0.6%, and the S&P 500 returned a massive 9.1%, the eighth largest monthly percentage increase in more than 35 years (see Exhibit 1).

Risky asset classes have had an outstanding year. Through the end of November, the S&P 500 realized a cumulative return of 20.8%, and high-yield corporate bonds and bank loans generated 9%-12% returns.

The investment environment has been dominated by Federal Reserve interest rate policy. After increasing the fed funds rate by 5.25% since the beginning of 2022, the Fed is very likely done hiking. Both the market and Fed Chairman, Jay Powell, have now begun to focus on when the Fed will begin to cut rates – and to what extent.

Exhibit 1. 2023 Monthly and Year-to-Date Returns

Source: Bloomberg, AAFMAA Wealth Management & Trust

In this month’s commentary, Senior Portfolio Manager Kristin Ketner Pak analyzes the rapidly growing anti-obesity medication sector. Kristin discusses the global backdrop of obesity, the development of GLP-1s, and related stock market opportunities.

We hope you find this overview insightful.

On behalf of everyone at AAFMAA Wealth Management & Trust, we wish you a happy holiday season!

Yours In Trust,

Paul

Economic and Market Commentary

What are GLP-1s?

There has been much discussion in the press and media recently about GLP-1s, or glucagon-like peptide 1s, and optimism that they could be a panacea for the worldwide obesity problem.

GLP-1s burst onto the scene in 2021, when the Danish pharmaceutical company, Novo Nordisk (NOVO), received FDA approval for the anti-obesity medication (AOM), Wegovy, marketed for years as Ozempic to treat type 2 diabetes.

Clinical trials have shown that GLP-1s are the most effective weight loss drugs or AOMs developed, with patients seeing 10% and up to as much as 30% weight loss. They are nearly as effective as bariatric surgery, which reduces the size of the stomach to curb appetite and, to date, have been the most effective obesity treatment with an average weight loss of 25-35%.

GLP-1s were originally developed to treat type 2 diabetes and mimic the action of a hormone called glucagon-like peptide 1. When blood sugar levels start to rise after someone eats, these drugs stimulate the body to produce more insulin which helps lower blood sugar levels. They have the effect of reducing hunger and appetite.

We, like many, believe that GLP-1s are a once-in-a-few-decades medical breakthrough that could have a positive impact on obesity and economic growth worldwide; however, we also recognize that this will take a long time and that multiple factors could suppress how quickly GLP-1s penetrate the obese population.

Obesity is a considerable problem worldwide.

According to the World Obesity Federation’s (WOF) World Obesity Atlas 2023, 14% of the world’s population was obese in 2020, while 38% were classified as overweight or obese. This is expected to rise to 24% and 51%, respectively, by 2035.

Obesity is defined as having a body mass index (BMI) greater than 30. BMI is defined as a person's weight in kilograms divided by the square of their height in meters.

Obesity is a global issue that is positively correlated with income. Higher-income countries had a 19% higher incidence rate of obesity than lower-income countries in 2020.

And the U.S. is seemingly ground zero for this issue with 42% of American adults obese, according to the National Health and Nutrition Examination Survey, from 1976–1980 to 2017–2020 (NHANES survey). Nearly 20% of U.S. children are obese.

The incidence of obesity in the U.S. has seen a dramatic 37% increase over the past decade, according to Trust for America’s Health (TFAH) report, The State of Obesity: Better Policies for a Healthier America 2023 (the TFAH report). And prevalence continues to grow, as the WOF 2023 Atlas predicts that 58% of U.S. adults will be obese by 2035.

Over the last 20 years or so, the prevalence of obesity has increased across all genders, races, age groups, income groups, and educational strata.

There are many health issues associated with obesity.

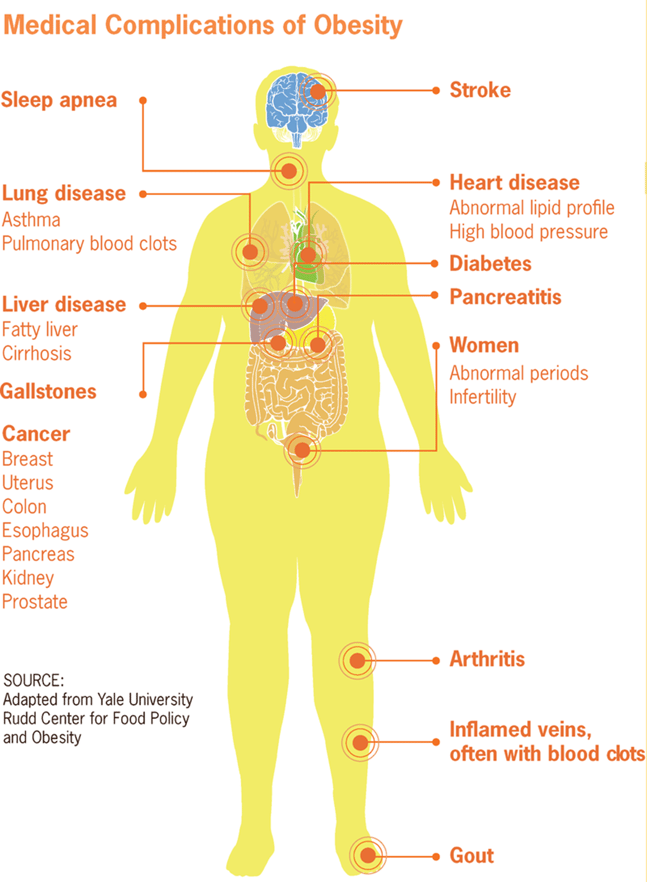

There are more than 200 possible health complications associated with obesity, including type 2 diabetes, cardiovascular disease, some forms of cancer, as well as mental health concerns, and reduced quality of life, according to NOVO and Eli Lilly & Co. (LLY), the manufacturers of GLP-1s (Exhibit 2).

Exhibit 2. Health Complications Associated with Obesity

Source: Yale University Rudd Center for Food Policy and Obesity

Obesity-related ill-health accounted for over five million deaths globally in pre-COVID-19, or approximately 10% of worldwide deaths, with more than half of these deaths occurring among people under 70 years old, according to the WOF.

COVID-19 brought even greater attention to the health risks of not just being obese but, more generally, of being overweight. In countries where more than half of the population was overweight, the death rate from COVID-19 averaged nearly four times higher than in countries where less than half of the population was overweight.

The costs of obesity are high.

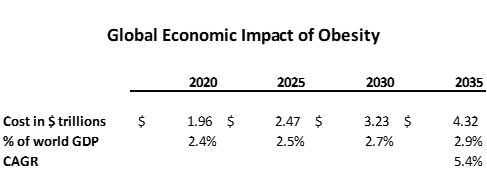

The costs of obesity are high and extend beyond the direct medical costs of treating the disease. The WOF estimates that the total economic cost of obesity worldwide is nearly $2 trillion a year, or 2.4% of world GDP, and it projects the cost to grow at about a 5%-6% compound annual growth rate (CAGR) to as much as over $4 trillion or 2.9% of world GDP by 2035 (Exhibit 3).

Exhibit 3. Global Economic Impact of Obesity

Source: World Obesity Federation, World Obesity Atlas 2023

The rise in costs will be particularly acute in upper middle-income countries, but increases are predicted in every region of the world. The two largest economies, the U.S. and China, are estimated to see the most significant dollar impact, collectively nearly $13 trillion by 2060.

Only one-third of these costs is estimated to come from the direct healthcare costs of treating obesity and its related medical conditions, with indirect costs, including the negative impact on the economy due to reduced worker productivity, absenteeism, and premature retirement or death, comprising two-thirds or the majority.

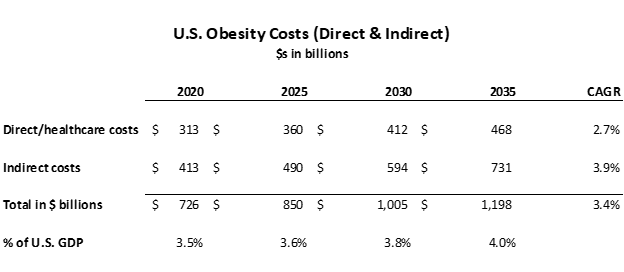

In the U.S. in 2020, according to the WOF 2023 Atlas, costs related to obesity totaled approximately $725 billion, or 3.5% of GDP, with direct and indirect costs equating to 40% and 60% of the total, respectively. These costs are expected to be 4.0% of GDP by 2035, driven by increased obesity prevalence (Exhibit 4).

Exhibit 4. U.S. Obesity Costs (Direct & Indirect)

Source: World Obesity Federation, World Obesity Atlas 2023

Given the size of the obesity issue, the market potential for GLP-1s is considerable.

Given the size of the worldwide obesity issue, one can see why there is such excitement around GLP-1s.

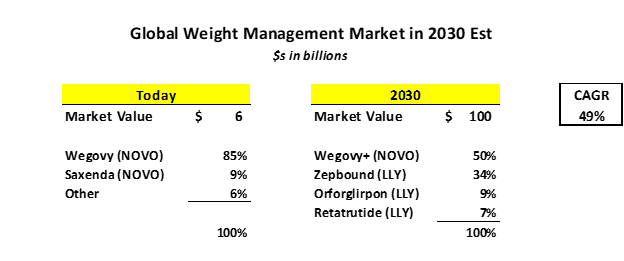

Goldman Sachs estimates that the global market for AOMs can reach $100 billion in 2030, up from an estimated $6 billion currently – about a 50% CAGR. In just two years since FDA approval, NOVO’s Wegovy has grown from $0 to a nearly $5 billion drug (Exhibit 5).

Exhibit 5. Estimated Global Weight Management Market in 2030

Source: Goldman Sachs Investment Research

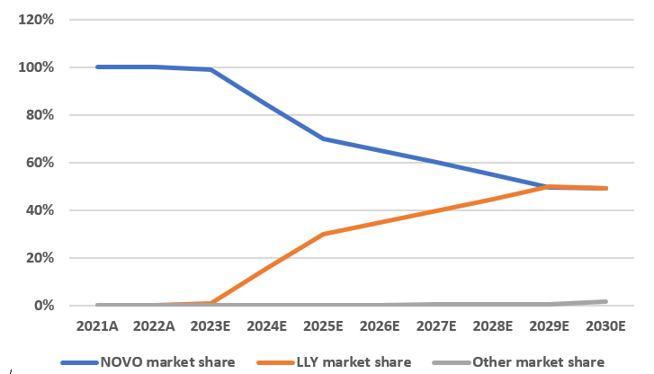

Further, Goldman Sachs, along with Cowen and JP Morgan, estimate the market, globally and in the U.S., will be shared evenly between NOVO and LLY (Exhibit 6).

Exhibit 6. Global Anti-Obesity Medication Market Share, 2021 Actual – 2030 Estimated

Source: NOVO and LLY data, JP Morgan estimates

There are some governors of growth of GLP-1s.

The pace and level of adoption of GLP-1s will be governed by multiple factors.

For one, these drugs are very expensive and can cost upwards of $16,000 a year, depending on healthcare coverage.

At this point, GLP-1s are not covered by many private health plans and, more importantly, aren’t covered by Medicare and Medicaid, which provide health care coverage for approximately 150 million Americans – 60 and 90 million, respectively. It’s estimated that Medicare and Medicaid currently bear nearly half of annual obesity-related direct medical costs.

Medicare’s lack of coverage influences the entire healthcare market, as many private insurers follow Medicare’s lead. Medicare is prohibited by federal law from covering AOMs with the rationale that obesity is linked to lifestyle choices rather than a medical condition and such treatment is considered cosmetic.

In contrast, all state Medicaid plans are required by federal statutes to cover necessary obesity treatments for children, but obesity treatment for adults is optional. According to a 2023 survey by Bloomberg Businessweek, only 10 state Medicaid plans offer broad-based coverage of AOMs.

There have been some efforts to recognize obesity as an illness and push for Medicare coverage. The American Medical Association recognized obesity as a chronic disease in 2013. The Treat and Reduce Obesity Act was introduced initially in 2013 (and reintroduced in July 2023), with the aim of overturning the Medicare prohibition.

Additionally, treating nearly 125 million obese adults and children in the U.S. with GLP-1s would be cost-prohibitive. According to Dr. William Dietz, the director of the Sumner M. Redstone Global Center for Prevention and Wellness at the Milken Institute School of Public Health at The George Washington University, “One of the most challenging decisions for health plans…is who to treat and how…Health plans cannot afford to start everyone in their plan with a BMI over 40.” Dr. Dietz continues that “The lifetime of expense of the newest generation of drug therapy will break the bank.”

There are also capacity constraints limiting production of the drugs currently, although NOVO and LLY are ramping as quickly as they can.

Also, the drugs are injectables which might limit usage at the onset, but new ingestible forms are expected to arrive in the next couple of years.

Finally, patient acceptance is a question mark too. Bariatric surgery is covered by Medicare but has relatively low uptake. One study found that Medicare patients had 22% lower odds of undergoing bariatric surgery than patients with private health insurance.

Investment considerations

The success to date of GLP-1s in treating obesity is an obvious positive for the manufacturers of these drugs, NOVO (Wegovy) and LLY (Zepbound), and for economies worldwide which could see higher workforce participation and productivity, and GDP growth.

LLY and NOVO are winners that have a multi-year head start on competition, a multi-year patent protection, and seemingly will share an enormous market opportunity. LLY has seen its stock rise about 55% in 2023. NOVO has seen its stock rise more than 40% over the same period. Since the launch of Wegovy in 2021, NOVO’s stock price has nearly tripled.

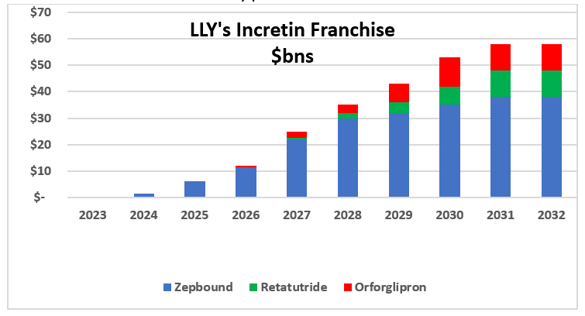

LLY’s overall incretin franchise (including GLP-1s and gastric inhibitory peptides (GIPs)) is estimated by JP Morgan and Goldman Sachs, to grow from $0 to nearly $50-$60 billion in less than 10 years, with the anti-obesity indication Zepbound alone totaling nearly $40 billion (Exhibit 5). For context, LLY’s total revenues were $32 billion over the last 12 months.

Exhibit 7. LLY’s Incretin Franchise, $billions

Source: Goldman Sachs Investment Research

Given its U.S. presence, longer patent lives, and the seemingly better drug efficacy of Zepbound, LLY would be our top choice in the AOM sector.

Alternatively, a short case has emerged that assumes lower obesity prevalence will result in less food consumption and fewer health issues, like diabetes. PepsiCo (PEP), one of the largest snack manufacturers (Frito Lay) in the world, has seen its stock fall approximately 7% year-to-date despite 10% EPS growth. DXCM, the largest manufacturer of glucose monitoring systems, has seen its stock price increase only about 8-9% year-to-date despite close to 60% EPS growth. SYK, a manufacturer of orthopedic implants, has seemingly shrugged off concerns for fewer orthopedic procedures with its stock up nearly 20% year-to-date on 10% EPS growth.

We don’t necessarily agree with the short case. We think that given the potential value of the AOM market and the breadth and depth of the food and medical device markets, both the GLP-1 manufacturers and the food and medical device manufacturers can generate attractive returns.

Goldman Sachs estimates that GLP-1s will penetrate 13% of the U.S. obese population by 2030 to arrive at their $100 billion worldwide AOM market estimate. The U.S. obese adult population is expected to grow, according to the WOF, at a 3-4% CAGR over that time frame. So, in seven years, with 13% penetration, GLP-1s will be treating 15-18 million obese people, but the adult obese population is estimated to grow by 30 million people over that time frame. In effect, LLY and NOVO are chasing a market opportunity growing faster than they can serve it.

Given this dynamic, we believe the ultimate impact on companies like PEP and SYK will be minimal. Even if GLP-1s are ultimately effective at slowing the prevalence of obesity – as we expect they will be – it will play out over many years. These companies will have time to react, exercise pricing power, and introduce new products to offset a worst-case low-single-digit volume decline.

Further, certain medical conditions don’t go away with weight loss. For example, SYK thinks that GLP-1s could increase patient eligibility for orthopedic procedures, as many obese patients are currently disqualified, which could create a near-term boost to demand.

So, it seems that GLP-1s may not be the panacea hoped for to solve the worldwide obesity problem. As Dr. Dietz points out “With 42% of the population having obesity, we have to recognize that we are not going to treat our way out of this disease.” Other preventative measures, such as nutrition and physical activity, must also be pursued.

Although GLP-1s can’t make obesity go away, they should still be a very successful treatment and develop into a sizeable market and continued investment opportunity. We think it is prudent to participate in this once-in-a-few-decades medical breakthrough.

Increase Your Financial Fitness with AWM&T

At AAFMAA Wealth Management & Trust LLC, we are committed to serving the unique financial needs of the military community. Whether you require a complimentary portfolio review, a comprehensive financial plan, assistance with your investment strategy, or trust services, our military wealth management professionals are ready to serve you. Contact us today to set up an appointment with a Relationship Manager who can assess your financial health and customize your personalized action plan.

About Us

Founded in 2012, AAFMAA Wealth Management & Trust LLC (AWM&T) was created to meet the distinct financial needs of military families. We proudly deliver experienced, trustworthy financial planning, investment management, and trust administration services – all designed to promote lasting security and independence.

We are proud to share the mission, vision, and values of Armed Forces Mutual, our parent company. We consistently build on the Association’s rich history and tradition to provide our Members with a source of compassion, trust, and protection. At AWM&T, we are committed to serving as your trusted fiduciary, always putting your best interests first. Through Armed Forces Mutual's legacy and our financial guidance, we provide personalized wealth management solutions to military families across generations.

© 2024 AAFMAA Wealth Management & Trust LLC. Information provided by AAFMAA Wealth Management & Trust LLC is not intended to be tax or legal advice. Nothing contained in this communication should be interpreted as such. We encourage you to seek guidance from your tax or legal advisor. Past performance does not guarantee future results. Investments are not FDIC or SIPC insured, are not deposits, nor are they insured by, issued by, or guaranteed by obligations of any government agency or any bank, and they involve risk including possible loss of principal. No information provided herein is intended as personal investment advice or financial recommendation and should not be interpreted as such. The information provided reflects the general views of AAFMAA Wealth Management and Trust LLC but may not reflect client recommendations, investment strategies, or performance. Current and future financial environments may not reflect those illustrated here. Views of AAFMAA Wealth Management & Trust LLC may change based on new information or considerations.

Get In Touch!

Schedule a consultation with one of our expert financial planners today, and let's hit the fast-track to success!

Schedule A Consultation