Blog

Monthly Market Commentary – November 2022

Halloween is here again. Brooke and I go to a neighborhood party each year. Adults dress up according to the theme provided by the hosts. Guests then vote for a winning couple who earn a trophy to display prominently on their fireplace mantle with pride (or something like that). We’ve won twice. In each case, we may or may not have encouraged the children to vote for us in overwhelming numbers. This year, children were not invited and we didn’t place.

For the past decade or so in the aftermath of the Great Financial Crisis of 2008-2009, the Federal Reserve and other central banks have been doing a version of what Brooke and I may have done to win. Instead of ringing up excess votes from children to boost the vote totals, the Federal Reserve and European Central Bank boosted the currency circulation in the economy in an attempt to beat the disinflationary forces acting against the economy (globalism, debt overhangs, technological innovation, etc.).

Whether that worked or not is a matter of conjecture. Who knows, Brooke and I might have won based upon the excellent or humorous nature of our costumes in the past. What is true is that the rules of the game changed dramatically and that had a large effect on the outcome. While the Federal Reserve and ECB were printing dollars in the aftermath of the Great Financial Crisis, the respective fiscal authorities scaled back (somewhat). The US Government entered into a stalemate on spending called “Sequestration”. In Europe, government debt balances caused problems for the monetary union and ended in “Austerity”. In both cases, printing money did not lead to rampant inflation.

One of my favorite commentators on inflation and government debt is Lacy Hunt, of Hoisington Investment Management. He has a distinct view and a wealth of experience having worked at the Fed as an economist during the 1960’s and 1970’s. Listening to various podcasts of his while we were locked down two years ago, one particular sentiment set with me. He was asked, what would make him believe that inflation would potentially get out of control. After reiterating his long term pessimism based upon slowing growth rates and demographics, he noted that if the Federal Reserve’s liabilities became legal tender (currency), then the printing press would be unstoppable.

I thought very hard about the implications of that statement and wondered to myself if the fact that Jerome Powell, Donald Trump, and Nancy Pelosi (and then Joe Biden substituting for Donald Trump in 2021) were all working in concert to finance the huge Covid-19 related expenditures with debt issued by the treasury and purchased by the Federal Reserve had in effect enabled Congress to co-opt the printing press from and deactivate the “independence” of the Fed. A government printing more and more paper would eventually have a dramatic effect on the purchasing power of that paper. Bewilderingly, inflation remained stubbornly low during 2021. But in 2022, the effects of the 2021 printing, plus the additional printing in early 2022 as the economy had essentially recovered from the pandemic induced recession, sealed our fate.

We could no longer use our Halloween costumes to conceal our true identities. Behind the batman mask were excess dollars. Under Superman’s cape were excess dollars. In every trick or treat basket were excess dollars – and that means inflation.

But eventually Halloween ends. The trophy ends up on the mantle and gathers dust. The dollars get spent or saved. Spending slows. And the sugar high gives way to a belly ache from too much candy. The Federal Reserve has reversed course and is handing out toothbrushes an apples instead of full size Hershey bars this Halloween.

Market participants are looking for a “Fed pivot”. As I write, the Federal Reserve has begun its two day November meeting. I won’t have the benefit of knowing what they’ve done before this goes to print. However, there are two paths.

In the first, market participants will be surprised (somehow!) to learn that the inflation figures most important to the Federal Reserve have not yet begun to slow. In fact, some have accelerated or at least remained stubbornly elevated since Chairman Powell’s August speech in Jackson Hole. The Fed will continue its hawkish tone through its statement and the ensuing press conference. Markets will view this as an indication that we are headed for recession in the US and broadly, asset classes will act that way.

In the second, the Fed will hint that it is willing to slow the pace of future rate increases as its terminal rate (or what they view as the endpoint for hiking rates) approaches. They will talk about long and variable lags to monetary policy – it takes time for monetary policy to work its way through the economy. Markets may view this as an indication that any recession may be mild or that the economy may avoid a recession altogether. Markets may also potentially price in the risk that inflation will accelerate again and the Fed will be forced to change course.

My own view is that the Fed ought to do the first and not the second. I have never been an inflation hawk because I have never had to be one. I have mostly only known falling interest rates and inflation during my career as an investor. But Halloween is over. It’s time to take the decorations down. End our frivolity and get serious again.

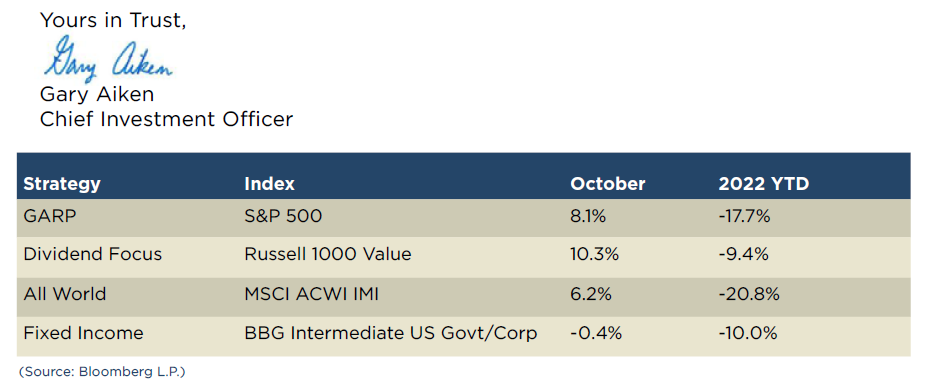

We have positioned client portfolios to be cautious on equities, but still able to benefit from a rise in equities over the near term if that materializes. We have also shortened bond portfolio durations to limit volatility and reduced credit risk. Finally, in our “All-World” portfolios we have maintained a significant US overweight.

In previous letters, I have talked about the three stages I expect from markets this cycle. First was the re-rating of valuations due to rises in the level of interest rates. Much of that move may have already occurred. How the Fed reacts will have a significant impact on that factor.

The second re-rating of valuations is due to earnings deceleration and declines. We have begun to see that as third quarter earnings start to roll out. While Energy and Healthcare sectors seem generally unaffected, other sectors reveal company by company dependencies on the resiliency of their customer base to absorb price increases and each company’s ability to weather higher input costs and supply chain delays. Many companies are guiding investors to expect lower profit margins and revenues going forward. That guidance will prove substantially worse if a recession (stage 3) occurs.

November will be a busy time. A meeting of the Federal Reserve Open Market Committee, Mid Term Elections, and quarterly earnings all before Thanksgiving. Should the Fed continue to tighten and the Congress be taken by the Republicans, I believe that the previous joining of monetary and fiscal policy during 2021 to loosen conditions will be offset by joint tightening of conditions in 2023. This means that inflation may come under control at least in the United States. Investors in that case may find a reason to buy financial assets again during Thanksgiving sales - valuable gifts to give during Christmas that will appreciate in the years to come.

At AAFMAA Wealth Management & Trust, we are dedicated to making your financial future as secure as possible. We provide all you need to know about post-retirement military wealth management, starting with a free portfolio review. We strive to learn about your goals and your level of risk tolerance and help you chart your course, build your wealth, and plan your legacy. For all you have done for us, it is the least we can do for you. Your selfless service to our nation deserves our unparalleled military financial service. We salute you.