Blog

Monthly Market Commentary – October 2022

Several years ago, our custodian, the Northern Trust Company, led presentations about the future of the economy with a simple statement. “There are three things that have historically caused recessions: an energy shock, a geopolitical crisis, or a central bank (Federal Reserve) mistake.” As I’ve noted on several webinars and in my commentaries this year, we now have all three. You can see the results in your grocery store, at the gas pump, on the nightly news, and soon in your investment statements.

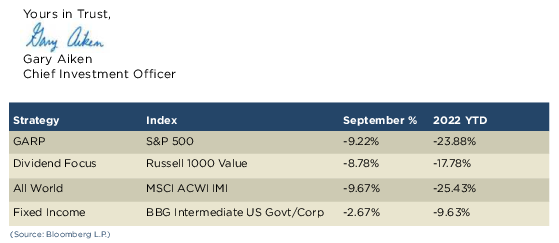

The third quarter of 2022 will not be remembered fondly by anyone who was forced to watch their Bloomberg screens each day. The July rally followed into absurdity in August. The downdraft that led to the lows of the year being reached at the end of September was a damaging reminder of how brutal the coming global recession may be. Of the 503 companies in the S&P 500 Index, 139 reached 52-week lows on September 29 or 30.

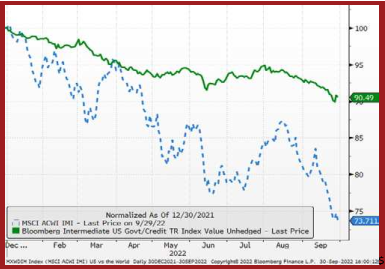

In the financial press and the financial planning community, much has been made about how terrible this year has been for the proto-typical “balanced” portfolio. This balanced portfolio is typically comprised of 60% stocks and 40% bonds. At AAFMAA Wealth Management & Trust LLC (AWM&T), the stock portion of our 60%/40% benchmark is comprised of either the S&P 500 or the MSCI ACWI IMI (Morgan Stanley Capital International All-Country World Investable Market Index). This is fairly common. Our bond benchmark is the Bloomberg Intermediate Government/Corporate Index while the typical bond benchmark in the financial press is the Bloomberg Aggregate Bond Index (formerly Lehman Aggregate Bond Index – or just “the Agg” for short).

The Agg has gotten absolutely crushed this year. The duration of the benchmark started 2022 at the longest in its history. Also, that index contains a large allocation to mortgage bonds – which have been hit by the double whammy of duration and negative convexity. Duration (modified duration to be specific) is a measurement that describes the expected price movement of a bond, as interest rates go up or down. A bond with a duration of 8.5 years for instance, like the on-the-run US 10-year Treasury Note at current rates, should go up about 8.5% if interest rates go down one percentage point or 100 basis points (a basis point is 1/100 of a percent). Likewise, if interest rates go up by 100 basis points, a bond investor would expect to lose 8.5% of their money in this “risk free” investment.

Mortgage bonds carry negative convexity. Think of convexity as an amplifier of the movement in price as interest rates go up or down. Mortgage bonds are more sensitive to larger changes in interest rates. Why? Well, if you’ve refinanced or bought a home in the last two years, you received an interest rate of between 2.5% and 4% on your 30-year mortgage. With interest rates at 7%, how likely are you to refinance? With inflation at 8% how likely are you to prepay your mortgage? Probably very unlikely on both counts unless you sell your home or default.

Mortgage investors assume a certain level of prepayments each month. As interest rates go up, those assumptions change and the speed at which an investor gets their principal returned declines rapidly. With principal payments pushed out into the future, the duration of the bond extends. The effect of our frenemy modified duration gets larger and larger. Hence, a mortgage bond with a 5-year duration, becomes a mortgage bond with an 8-year duration or longer and this becomes a double whammy -- an accelerant.

This longer duration and allocation to mortgage bonds means that the Agg has declined 14.6% in 2022 versus our benchmark for bonds at -9.6%. No one has been safe, but our aversion to the composition of the Agg has added value relative to the average bond investor in a typical 60/40 portfolio. Our client bond portfolios this year have been far shorter in duration than our benchmark. While I can’t quote composite performance in these pages, I encourage our clients to review their relative bond outperformance this year against the backdrop of our benchmark and their likely allocations to bonds in the Thrift Savings Plan F fund, which is indexed against the Agg.

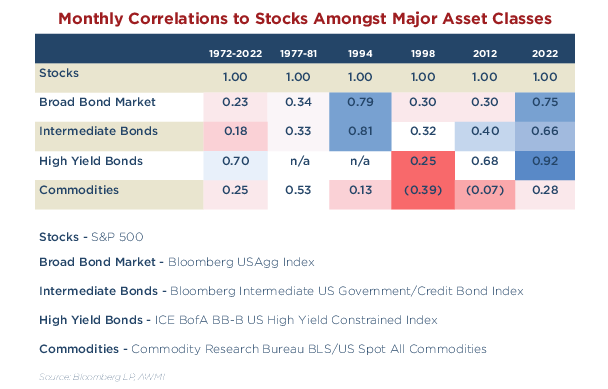

Aside from historically bad performance in bonds in isolation (and I’ll return to this later), another striking feature of 2022 has been the breakdown in correlations amongst major asset classes. The financial industry generally relies upon historical data to draw conclusions about how different asset classes like stocks, bonds, commodities, real estate and cash will act over time against each other. I’m sure many readers have been told (erroneously), “we own bonds because when stocks go down, bonds will go up.” While this may happen from time to time, the more correct way to say it is that the positive correlation is small and that when stocks go down, bonds will go down far less than stocks – a low, positive correlation. Some asset classes are supposed to have negative correlations – that is, when stocks go down, they actually go up. I want to share a chart showing monthly correlations between stocks (the S&P 500) and other asset classes over some historically turbulent periods.

I’ve shaded the boxes so that the dark blue boxes indicate when asset classes are highly correlated. You’ll see that similar to 1994 when the Fed last embarked on a significant rate increase to curb inflation, bond returns were highly correlated with stocks. Over the longer run though (the whole period 1972 to 2022 YTD) investment grade bonds and commodities have provided significant diversification benefits to portfolios. This year is a significant outlier, even more so than the Volker years. Why?

We have never emerged from zero or negative interest rates before. We have never had central banks successfully exit the buying of bonds through quantitative easing and other extraordinary monetary expansion efforts. With massive inflationary pressures finally let loose on the global economy, we have no choice. Nassim Taleb, the economic philosopher and writer, compares coming off the zero bound like imposing gravity upon a society that has been able to ignore physics. I struggle to find a metaphor appropriate to the situation, but at the very least, the global financial system has been shocked to a level not seen in a very long time, and in a way that is significantly different from the previous experiences since 1982.

Can I offer a glimpse into the future? Perhaps. Our view has not changed:

First, the Federal Reserve will continue to raise rates to fight inflation in the United States. The investment implications of this are: (1) We should expect interest sensitive assets (stocks, bonds, real estate) to perform poorly in the short-term relative to long-term average performance; (2) We should expect that the dollar will continue to strengthen making foreign investments less attractive; and (3) we should expect company earnings to decelerate and/or decline as the effects of tightening monetary policy take their toll on economic activity in the US and around the world. AWM&T has taken stock allocations to neutral or below. We have nearly eliminated non-US equity exposure. That said, I think the theme song for the corporate earnings season starting in two weeks is likely to be “Nowhere to Run, Nowhere to Hide” by Martha and the Vandellas. I would rather be “Dancing in the Street,” but that seems unrealistic at this point in the cycle.

Second, the Russian/Ukrainian War continues to escalate. Putin’s latest aggression to annex additional sovereign Ukrainian territory and the near permanent destruction of Nord Stream 1 and Nord Stream 2 means there is no end to the hostilities or hope for European energy relief in sight. The provenance of the pipeline destruction is unknown and relatively unimportant from an investment standpoint. Oil and natural gas resources will become dearer. The United States will eventually end its release of oil from the Strategic Petroleum Reserve. We expect energy producers to continue to profit and return cash to shareholders.

Third, October will be an important month for developments out of China. The twentieth party Congress is set to commence mid-month. China is a black box in many ways. Due to the difficulty of ascertaining the true direction of Chinese economic activity and due to the fact that we are an organization that serves the American Armed Forces and their families, we have abstained from investing directly in China. However, any remotely positive developments from Beijing (political or economic) would be extremely bullish for risk assets.

Finally, I want to revert to the mean. The positive and unusually high correlation between stocks and bonds is a result of bonds coming off the zero bound. We are no longer at the zero bound in the United States. The two-year US Treasury Note yields 4.25%. The Federal Reserve is undoubtedly closer to its target and to achieving its goal than it was when it finally embarked on tightening policy a year ago. At some point, and that point is getting closer, correlations will revert to their long-term averages. That doesn’t mean that we are at a turning point for stocks or that September 2022 are the lows, but on a relative basis, stocks are more attractive than they were at the beginning of the year and long-term investors should be thinking about moving cash from the sidelines over the next few quarters into both stocks and bonds.

To that end, I sincerely hope that any reader who is qualified to become a Member of AAFMAA due to your military service, takes advantage of our superb financial planning services. Having a plan to achieve financial independence will calm a worried mind in troubled times. AAFMAA Wealth Management & Trust celebrates its 10th anniversary in business this month. I am excited about our future. I am optimistic about the future of the United States. I look forward to serving you and your family.

At AAFMAA Wealth Management & Trust, we are dedicated to making your financial future as secure as possible. We provide all you need to know about post-retirement military wealth management, starting with a free portfolio review. We strive to learn about your goals and your level of risk tolerance and help you chart your course, build your wealth, and plan your legacy. For all you have done for us, it is the least we can do for you. Your selfless service to our nation deserves our unparalleled military financial service. We salute you.