Blog

Monthly Market Commentary – July 2022

As I write this commentary, we celebrate the Fourth of July – our nation’s Independence Day. We follow the charge of John Adams to solemnize the day, “With Pomp and Parade, with Shews, Games, Sports, Guns, Bells, Bonfires and Illuminations from one End of this Continent to the other from this Time forward forever more.” To my child who relishes fireworks, the noise and commotion are a great joy. For my other son, to whom loud noises make him recoil, although the meaning of the day is clear, the method of its celebration is too much to handle.

Markets in the first half of 2022 were characterized by loud noises and terrifying displays of red on the screen in almost every market around the globe. Markets were punishing and unforgiving. Open almost every hour of every day somewhere around the globe, the new data was relentless. The number of pundits, analysts, and Twitter experts are seemingly infinite. Everyone claiming to be right about this or that, while the market declines day after day, can make even the professional investor self-conscious and insecure. For the average investor saving for college, retirement, or some other goal, the minute-by-minute reckoning can be like the July 4th fireworks for my youngest child – a deafening noise, too much to handle.

As investment professionals, we cannot ignore the noise. Our job is to contextualize and organize the incoming data and commentary. We categorize it, make choices about its relative importance, and decide whether or how to use it. We test and test again our hypothesis of the markets and our specific holdings through vigorous internal debate throwing statistics and minutiae at each other in a never-ending conversation. Ultimately we strive to answer two questions. First, does the new data fit within our view or should it change our view? Second, if the data changes our view, how should that change be reflected in our asset allocation or securities choices? As investment professionals, it is our fiduciary duty to consider the noise. Like John Adams and Independence Day, we try to find meaning in the moment of the markets’ fireworks.

Some investors are like my first son. They don’t mind all manner of noises. They recognize, like so many great investors, that sometimes markets go down. As Peter Lynch said to his audience at the Press Club in Washington, D.C. in 1994, “They go down a lot.” The Fourth of July may come once a year on a specific day, but stock markets go down with similar regularity. AAFMAA has been around for 143 years. Over those 143 years, the market has been in a bear market (when the market falls 20% or more, like 2022) about once every seven years[1]. This Association has experienced roughly 20 bear markets and we’re still going strong.

Investors with a long-view know that bear markets present great buying opportunities. In fact, after the average bear market has bottomed, the market returns to its pre-bear market level on average within three years. Three years may seem like a long time in the moment your funds are going in the wrong direction, but most investors’ goals and objectives are not that short, they are five, ten, fifteen or more years into the future. Bear markets are chances to buy great companies at fantastic prices.

Still, for some savers who are like my second son, markets going down are loud noises and too terrifying to ignore in the short run. At AAFMAA Wealth Management & Trust, we use a tool with our clients called “Riskalyze.” Riskalyze uses an interesting graphical and mathematical approach to show our clients what a bear market decline means in dollars given their specified investment objectives and associated level of risk tolerance. While these models aren’t so precise as to predict exactly what will happen, they are close enough to align a clients’ investment objective with their risk tolerance.

The proof is in the pudding and after the first six months of this year, it is clear that this tool has adequately educated our clients. Few have modified their risk tolerance or fled for higher ground. I think this is clearly a wise decision for long-term investors. Although the fireworks of Independence Day (and this bear market to keep our analogy fresh) are loud and bright, they coexist with a greater meaning of the day that will remain long after the celebration is over and the noise subsides. With that, we hope that our clients and average investors will celebrate their freedom from market noise. Ignore the daily grind. Put it aside. Focus on your goal or objective. Realize that that goal or objective is not in the next few minutes, tomorrow, or next week, or even a year from now. It may be five, ten, or fifteen years into the future. Markets sometimes go down.

Last month I noted in my summary that we had moved our view to “cautious” in May. As a reminder, we noted three culprits for caution. First, that the Federal Reserve was tightening monetary policy to slow economic growth and curtail inflation. Second, that the Ukraine/Russia War was creating frictions in the supply and cost of agricultural and energy commodities. Third, that the Chinese Zero-COVID response was continuing supply chain shortages that would induce inflation and slower growth. Further, I noted that it was likely that these items, left alone, would likely induce a recession.

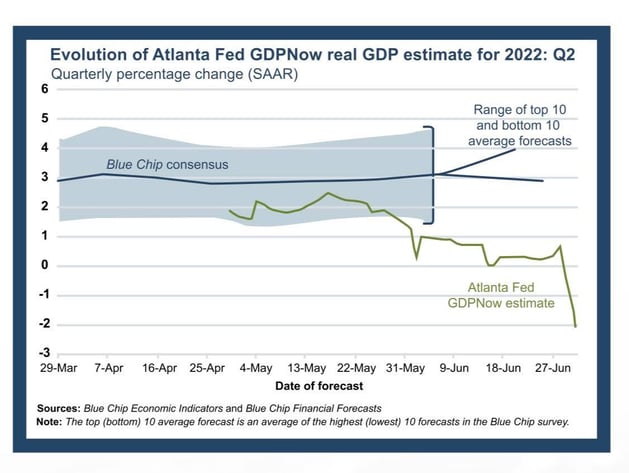

The chart below shows the latest projection from the Federal Reserve Bank of Atlanta’s “GDP Now” indicator (in red). You’ll note that the Atlanta Fed’s measure indicates that second quarter GDP at -2.1%. Combining that with the first quarter’s -1.6% GDP print and you have two consecutive quarters of negative growth, a market shorthand for recession.

If we are in recession, this has been a rather strange recession so far. Employment continues to rise and inflation has accelerated. While there are signs the consumer is weakening and demand is waning, the Federal Reserve is likely to continue raising the Federal Funds interest rate from its current 1.75% to what it deems to be a “neutral rate” or beyond in order to smash inflation. Federal Reserve Chair Jerome Powell has been quite clear with markets about his aggressive anti-inflation bias and it seems that political leaders on both sides of the aisle in Washington are eager to allow him to succeed (and take the political blame for the economic fallout of this policy).

I also noted last month that the first stage of our economic view was a reset of asset valuations due to interest rates, and that a second wave would be forthcoming in the form of a reset with respect to corporate earnings. In the last few recessions, as the chart below shows, corporate earnings have declined. Soon after the publication of this note, U.S. Corporations will begin to release their earnings for the second quarter and maybe tell us what they see in the early part of the third quarter. My expectation is that, in general, CEO’s will say that demand is waning and their profit margins are contracting from the highs of last year due to supply chain, currency translation, and inflationary pressures.

With that backdrop, AAFMAA Wealth Management & Trust portfolios remain cautious with respect to both bonds and stocks. We are actively looking to exit marginal technology stocks and enter positions in healthcare and consumer staples stocks. We are overweight U.S. companies versus ex-U.S. Developed and Emerging Markets. We continue to favor high-quality, short-duration, fixed-income securities.

My wife and I spent the evening this Independence Day with friends at their beach house on the Chesapeake Bay. As we looked out over the water at dusk, fireworks displays could be seen north in Annapolis, south in Chesapeake Beach, and east, across the bay in St. Michaels. Across the horizon, turning almost 180-degrees, no matter which way we spun, we could hear the boom and see fireworks in the sky. As I watched, I was reminded of two things. First, the United States of America is still the greatest place in the world, not only to live, but to invest. We have the deepest capital markets, the best regulations and shareholder protections, and the most innovative companies anywhere in the world. Second, that it is always important to have perspective. Keeping perspective means focusing on your long-term objective and investing with your particular risk tolerance in mind, especially in turbulent markets.

[1] Crandall, Pierce & Company. Chart 428S: “Why have a Disciplined Investment Approach?” June 2022.

At AAFMAA Wealth Management & Trust, we are dedicated to making your financial future as secure as possible. We provide all you need to know about post-retirement military wealth management, starting with a free portfolio review. We strive to learn about your goals and your level of risk tolerance and help you chart your course, build your wealth, and plan your legacy. For all you have done for us, it is the least we can do for you. Your selfless service to our nation deserves our unparalleled military financial service. We salute you.