Blog

2022 Year-End Market Commentary

As we move into 2023, let's look back at last year's trends. Global growth slowed through 2022 on a diminishing Covid reopening boost, fiscal and monetary tightening, effects of China's Covid restrictions and property slump, and the Russia-Ukraine war. As the New Year progresses, look for global growth to remain slow as a European recession and a bumpy China reopening offset U.S. resilience.

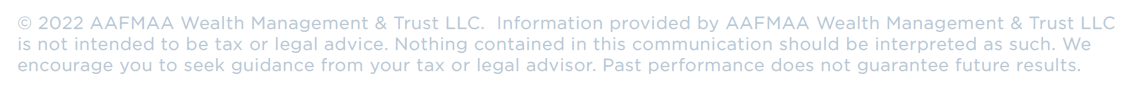

Source: Haver Analytics, Goldman Sachs Global Investment Research

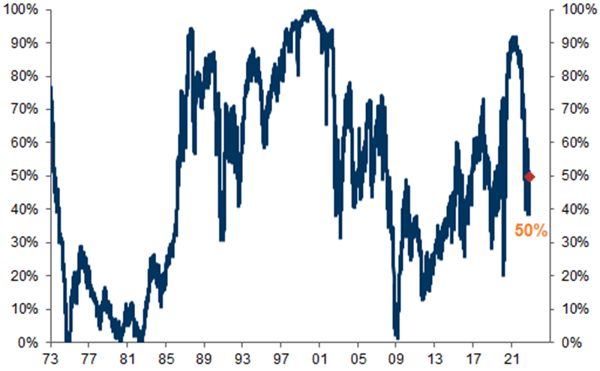

On a positive note, as shown in the chart above, current yields on fixed income investments now provide an investment alternative to stocks, marking TINA's end (There Is No Alternative to Stocks). Also, today's inflation is different, with unprecedented job openings, the disinflationary impact from supply chain easing, and housing markets normalizing.

Most asset prices embody only a partial risk of recession. So even after a long year of worry, the market is still vulnerable to lousy growth and inflation news. The balancing act for investors is how to position their portfolios for a wide distribution of outcomes, not just the expected central path reflected in consensus Wall Street analyst views.

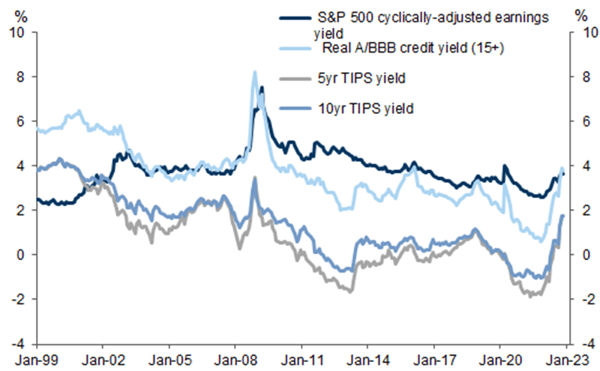

Source: The Wall Street Journal, Goldman Sachs Global Investment Research

Estimates of U.S. recession probability vary widely. The consensus probability of a recession this year is 65%. Nevertheless, the valuation picture has improved with the 2022 decline in asset prices. A year ago, expected returns across U.S. equities and fixed income were historically low. Amid one of the worst periods for balanced portfolios, the returns available on U.S. fixed-income securities are now higher than they have been for most of the last 25 years. U.S. equities may continue to prove frustrating in this environment. Avoidance of severe recession might limit the downside risk, but the growth upside may also be capped by the prospect of more Federal Reserve (the Fed) tightening.

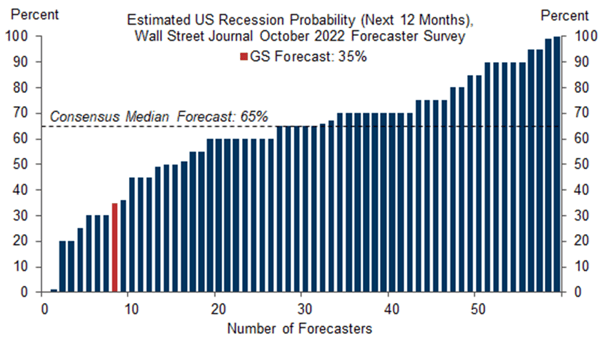

Structurally, capital may continue to flow towards the old-economy sectors of the economy, boosting industrial capacity, or we may see a significant recession with more severe demand destruction, moving the economy away from the capacity frontier and limiting price increases. There has been a significant rotation away from new-economy tech back towards old-economy energy. However, from a longer perspective, those shifts still look small, and we may need to see that trend extend.

Source: Goldman Sachs, Goldman Sachs Global Investment Research

New bull markets and convincing troughs are ushered in by a significant cheapening of assets and a convincing upswing in cyclical activity. A strong case for a significant upside in asset markets starts with deep cheapness. We’re not there.

Global Equities P/E Percentile

Source: Goldman Sachs, Goldman Sachs Global Investment Research

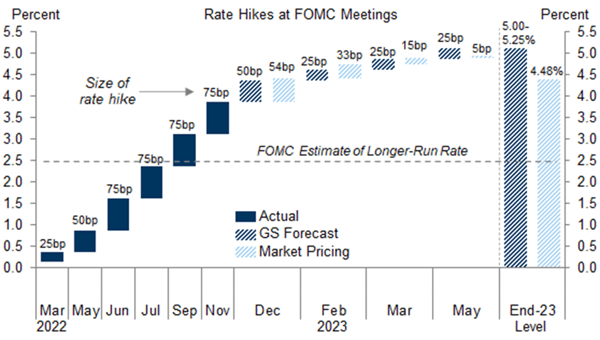

In the U.S., we expect the Fed's monetary tightening cycle and inflation will peak in 2023, with the Fed funds rate topping out at 5.00 - 5.25%.

Source: Bloomberg, Goldman Sachs Global Investment Research

As the headwinds from the pandemic's uneven reopening and global monetary tightening fade, look for growth in the second half of 2023. Expect a greater focus by global market participants on non-inflation risks, regionalization, more expensive labor and commodities, and more extensive and active governments. Look for lower returns, higher volatility, and a focus on margins over revenue.

The key economic question for 2023 is whether central banks can tame inflation without creating a recession. One risk is that inflation pressures stay pervasive enough that central banks have no choice but to keep tightening aggressively. If so, a recession might become unavoidable, not just in Europe but also in the U.S. The latest news has reduced this risk slightly in the U.S. as the labor market continues to adjust, and inflation has begun to slow. The other main risk is that underlying inflation does come down, but central banks are slow to recognize the improvement because they are too focused on lagging inflation indicators such as Consumer Price Index (CPI) housing inflation. Fed officials have made it clear that they are not only focused on the CPI rent numbers but also on leading indicators such as asking rents on new leases, which have slowed sharply in recent months.

Beyond the core inflation dynamic, there are concerns about political and geopolitical shocks, which could affect the global economy via higher uncertainty, tighter financial conditions, or adverse effects on commodity supply. A settlement in the Russia-Ukraine war does not seem nearby, and the impact of the price cap on Russian oil is uncertain. Political instability in the Middle East could also deal another blow to energy markets when the supply-demand balance is already precarious.

2023 Equity Outlook

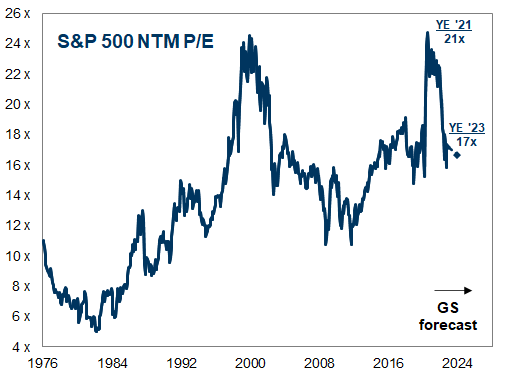

"‘The performance of U.S. stocks in 2022 was all about a painful valuation de-rating [a reduction in the price paid for earnings, or the P/E ratio], but the equity story for 2023 will be about the lack of corporate earnings growth,’ Goldman [Sachs] analysts wrote [in their 2023 equity outlook report]. ‘Put simply, zero earnings growth will drive zero appreciation in the stock market.’"1

Why won't earnings grow in 2023? The weighted average cost of capital (WACC) for S&P 500 firms in 2021 was at its lowest level in over four decades.2 Following a determined effort by the Federal Reserve to curb elevated inflation, financial conditions have tightened dramatically. The cost of money for capital investments by firms has gone up. The WACC has spiked to 6%, the highest level in a decade and the most significant 12-month rise in 40 years. It will remain near the current level in 2023. Higher costs of capital increase firms' expenses, reduce capital investment, and compress earnings, even if there is no recession or only a mild one. We expect very limited earnings growth if the Federal Reserve engineers a "soft landing." However, a miscalculation by the Federal Reserve could also result in a "hard landing," a more severe recession with falling earnings and decreasing stock market value.

The range of potential market outcomes in 2023 – from a flat stock market return under the base case to negative returns in a more severe recession – means investors should remain cautious. In 2023, it will be better to own resilient companies with strong profit margins, low interest rate risk, and pricing power that enables them to keep prices high as inflation fades. Avoid growth companies that are not currently profitable or companies that face pressure from increasing input costs.1 Earnings estimates are still too high in some stock market sectors, such as technology. When those earnings are adjusted downward, or actual earnings undershoot estimates, stock prices will drop in those sectors.

Source: Goldman Sachs Global Investment Research

Households will shift from equities to cash and bonds in 2023 as high real yields across asset classes shift investor mindsets from TINA ("There Is No Alternative to Stocks") to TARA ("There Are Reasonable Alternatives"). However, the pace of the shift will depend on the economic environment, and investors tend to rotate toward cash when the outlook for the economic environment deteriorates.

Some Good News

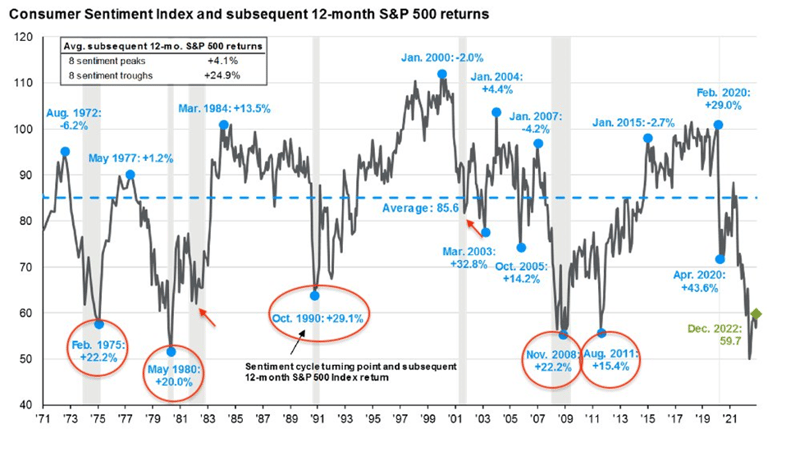

Consumer sentiment is bad. In the past 50 years, recessions were ending by the time consumer sentiment got this low. If the future continues to rhyme with the past, we may experience decent 12-month forward returns.3

Source: JP Morgan Chase

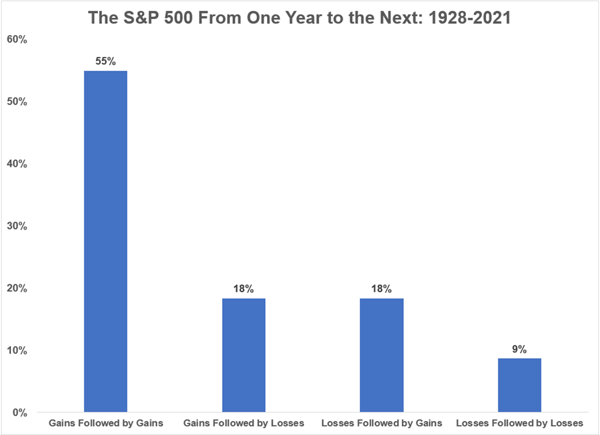

Also, a repeat of the losses of 2022 is historically unlikely. Global central banks are nearing the end of their monetary tightening campaigns.4 As Chairman Powell said recently, rates are 'getting close' to sufficiently restrictive levels. U.S. inflation has peaked, though it is still relatively high.

Source: A Wealth of Common Sense

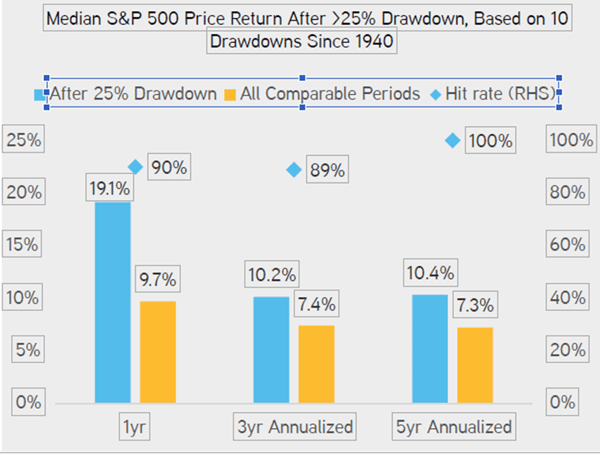

In closing, as we move through 2023, remember that the equity market is forward-looking, so after a rough 2022, forward returns look attractive.

Source: KKR Global Institute

Have a prosperous New Year!

Peter St. Denis, CFA®

Senior Portfolio Manager

At AAFMAA Wealth Management & Trust, we are dedicated to making your financial future as secure as possible. We provide all you need to know about post-retirement military wealth management, starting with a free portfolio review. We strive to learn about your goals and your level of risk tolerance and help you chart your course, build your wealth, and plan your legacy. For all you have done for us, it is the least we can do for you. Your selfless service to our nation deserves our unparalleled military financial service. We salute you.

-------------

1 - Goldman's stock market outlook 2023: 'Less pain but also no gain', https://www.investing.com/news/stock-market-news/goldmans-stock-market-outlook-2023-less-pain-but-also-no-gain-432SI-2949814.

2 - Mike Shell on Twitter: "A year ago, the weighted average cost of ..., https://twitter.com/MikeWShell/status/1595153003828641792.

3 - JP Morgan

4 - Outlook for 2023: Keep It Simple | KKR. https://www.kkr.com/global-perspectives/publications/outlook